Got medical bills? You’re not alone. One in five Americans ages 18 to 64 say that they, or someone in their household, has had problems paying medical debt in the past year.

That’s not exactly surprising. Medical bills can run thousands of dollars, even with insurance. But if you need help with medical bills, there are places you can turn to. Read on for some ideas.

Help With Medical Bills: 5 Ways To Put That Debt Behind You

1. Check Your Numbers

Let’s say you get your appendix taken out. Now, you owe the hospital $4,000. Or maybe you broke your thumb and went to an urgent care clinic. Suddenly, you’ve got a bill for $500 sitting in front of you.

Believe it or not, you still have some power with the provider—the hospital, clinic, doctor or whoever else gave you your medical care.

Here’s how you start: First, if you’re insured, wait until you get your insurance company’s explanation of benefits (EOB) before you pay anything. The EOB will explain:

- What the insurance company has to pay

- What you have to pay

Look for any discrepancies. If the insurance company says you owe $400, but you just got mailed a bill from the doctor for $800, there’s a problem. Call the insurance company to see if they can sort it out with the provider.

Also, look for any errors on your bill. It could be something as simple as a duplicate charge. You probably didn’t have two appendectomies.

Or there could be typos. Maybe the provider put down the wrong number for your health insurance policy. If that happened, your insurance company might have refused to pay the bill altogether (that’s called “denying a claim”). Stuff like this happens all the time.

Again, call the insurance company for help. They have more leverage with the provider than you do.

2. See If You Can Get A Fair Price

You know the price list you see at fancy coffee shops? Small Americano, $2.59. Large salted caramel mocha, $5.99. And so on. Hospitals have something similar, and it’s called a charge master. It’s a list of full prices they set. So, for example, an MRI might start at $3,000.

Then, insurance companies come in and negotiate discounts. So, if you’re insured by Insurance Company A, the hospital might bill you $500 instead. The insurance will cover part of that $500, and you’ll probably have to pay part.

Clinics, doctors, and other providers also have their own price lists. What’s the point? If you’re not insured, you will probably get charged the “charge master” price, which will take a bite out of your budget.

What can you do? Ask for a fair price instead. If you go to Healthcare Bluebook, you can look up different procedures and tests, and find out what an insurance company would usually pay for them at a provider in your area.

You could call the hospital back, for example, and say, “Hey. I know my bill is $3,000 for that MRI, but insurance companies normally pay you around $500. Now, there is no way I can pay $3,000. How close can you get to the insurance company price for me?”

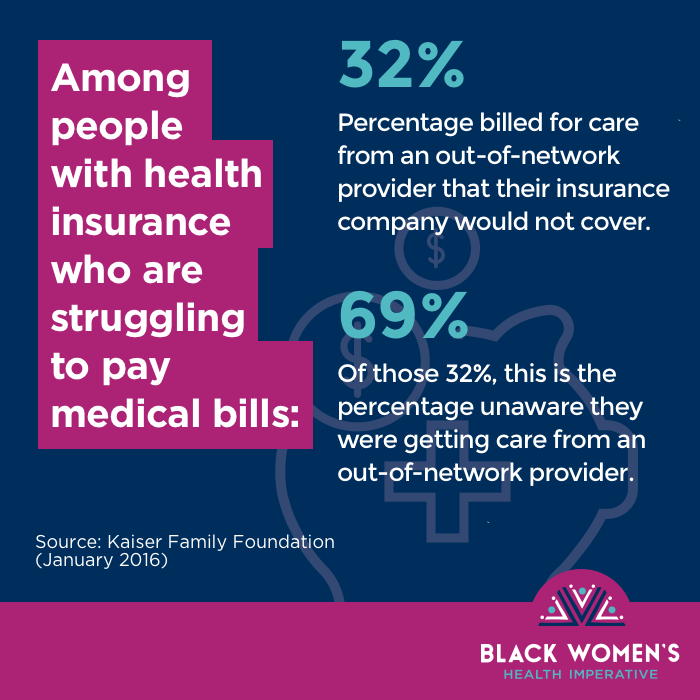

3. Watch Out For Balance Billing

Even if you’re insured, you might get hit with an out-of-network charge you’re not expecting. That happens when the hospital uses a doctor, or another provider, who’s not in your insurance network.

Here’s an example: You go in for surgery. The anesthesiologist puts the mask over your face. You didn’t pick him; the hospital did. And he seems nice enough. But unknown to you, that guy is outside of your insurance network. He’s going to cost you a lot more than an anesthesiologist who’s in your network.

Does this happen? Yes, all the time. Your insurance company will pay part of the guy’s bill, of course. But not all of it. You’re charged the difference, which could be hundreds or even thousands of dollars. That’s balance billing.

To deal with this, call the hospital and ask if they can revise your bill. Specifically, ask for the price you’d have gotten for an in-network provider.

Who do you ask for? The billing department. Start with the person who answers the phone. But be ready to hear, “I can’t do anything about your bill.” Then, ask for the manager of the billing department.

And be persistent about it. Say politely, “I’m staying on the line until I can speak with your manager.” It’s been known to get results.

4. Negotiate Other Parts Of Your Bill

Again, this is going to be a conversation with the billing department manager. Tell them, “I’m sorry, but I can’t pay $15,000”—and have the documentation to back that up. (For example, a pay stub, mortgage or rent payment receipt, utility bills, and other debts will do.)

The hospital might warn you that they’ll go after you in court, put the debt on your credit report, etc. And, yes, they can do these things. But if you can’t pay, you can’t pay. Tell them calmly that you understand, and you wish you could pay them, but you just don’t have the money.

Ask the provider to put you on a payment plan. Or offer to pay part of the debt, in full, and see what they say. You never know. If you show a willingness to cooperate, they might work with you. It’s cheaper for them than going to court. And less trouble.

Another tactic: See if the provider has financial aid available. Or if you’ve got a health savings account as part of your health insurance plan, use the money in that account. After all, it’s a tax-free savings account just for your medical expenses. If you can’t use it now, when can you?

5. Talk To A Medical Billing Advocate

A medical billing advocate is someone who can negotiate the bill for you. They can also look at your bill for errors and talk to your insurance company about any problems with your claims.

The catch—they can be expensive. They charge anywhere from 15% to 35% of the money they save you. Or, some charge upfront at $100 to $200 an hour.

But there are some nonprofit groups that help for free, or at a reduced rate. Start with the Patient Advocate Foundation. Also take a look at the National Association of Healthcare Advocacy Consultants and the Alliance of Claims Assistance Professionals.

6. Look For Financial Aid

Any provider’s billing department should be aware of at least some nonprofits who might help pay your bill. All you have to do is ask.

You can also talk to local groups like churches and the United Way. They can often refer you to resources that can help you.

Additionally, look to the government for help. Try USA.gov or MedlinePlus for a list of nonprofit and community groups that provide financial aid for medical bills.

With the cost of health care rising so high, many Americans are in the same situation with medical debt. Just remember that you’re not alone, and there are resources you can use. Keep knocking at the doors of these groups until you get the help you need. It can pay off in the long run.

Know someone facing large medical bills? Share this article with them.